Other ways to give

Some popular options are provided here but please call or email with questions

Tax-wise gifts

Owls have a reputation of being smart, and so are you when you carefully consider the tax consequences of your gifts! Smart tax-wise giving not only saves you money on your annual taxes. It also increases the impact of your gift to the Sisters of Benet Hill Monastery!

Ways to give

Many friends of the sisters are turning to this type of giving to make a greater impact on our mission and their taxes.

You can give any amount (up to a maximum of $100,000 per year) from your IRA to a qualified charity such as Benet Hill Monastery without having to pay income taxes on the money. This popular gift option is commonly called the IRA charitable rollover, but you may also see it referred to as a qualified charitable distribution (QCD for short). A gift directly from your IRA generates neither taxable income nor a tax deduction, so you benefit even if you do not itemize your deductions. And, beginning in the year you turn 72, you can use your gift to satisfy all or part of your required minimum distribution (RMD).

Stock gifts (including shares of mutual funds and ETFs) offer an opportunity to make a larger impact than you ever thought possible in supporting the monastery’s mission.

When you donate appreciated stock held for at least one year, we receive the full value of the stock and you avoid paying capital gains tax (which can be as high as 20%). You receive the same income tax savings that you would if you wrote a check, but with the added benefit of eliminating capital gains taxes.

Many of the monastery’s supporters use a Donor Advised Fund (DAF) for their charitable giving. Many supporters have established a DAF with the charitable arm of Schwab, Fidelity, or Vanguard. Other donors have established DAFs at their local community fund like the Pikes Peak Community Foundation.

Using a DAF simplifies your giving because it serves as a charitable giving savings account of sorts. It gives you the flexibility to recommend how much and when to recommend grants to qualified charities like the Sisters of Benet Hill Monastery. You receive a charitable deduction for the amount of that initial stock gift into the DAF and also avoid the capital gains tax.

Real property can be gifted to the Monastery and provide you with significant tax advantages. The charitable deduction value of the donated property is based on a professional appraisal of its market value at the time of transfer.

In-kind gifts

The sisters are able to use food items and many gently used or new items that you no longer need.

Ways to give

The answer to this changes often. It’s best to call first to inquire if the item you’d like to donate is needed.

Absolutely! Be sure to complete a form when you drop off your donation so that we may send you a thank you letter as your receipt.

For online shoppers

If you are an Amazon customer, please consider going to Amazon Smile and selecting the monastery as your preferred charity. When you shop at smile.amazon.com, Amazon donates 0.5% of your eligible purchases – at no cost to you. Unfortunately, Amazon has decided to terminate this program February 20, 2023. However, we will continue to update lists of items needed by the sisters.

Ways to give

It’s simple! Click on the link below which is unique to Benet Hill Monastery.

Yes, we have three lists: Retired Sisters, Hospitality, and Paper Products. Some of the items are one-time needs and others are recurring needs.

When logged into Amazon Smile, click on Account & Lists, then AmazonSmile Charity Lists.

Tribute gifts

Many friends prefer to make gifts in honor or memory of a special loved one. Often, friends and alumnae of Benet Hill Academy make gifts in honor or memory of a beloved Benet Hill sister.

Ways to give

The easiest way to make your gift is to click on the Give Now option to the right. Be sure to check the box saying “I’d like to dedicate this gift,” then follow the steps. We will send a card notifying your dear one of your thoughtful gift in their honor.

The easiest way to make your gift is to click on the Give Now option to the right. Be sure to check the box saying “I’d like to dedicate this gift,” then follow the steps. We will send a card notifying your dear one’s family of your thoughtful gift in their memory.

The easiest way to make your honoring gift is to click on the Give Now option to the right. Be sure to check the box saying “I’d like to dedicate this gift,” then follow the steps. We will tell the sister of your thoughtful gift, and she’ll probably call you or send a card!

To make a gift in memory of a deceased sister, you may follow the procedure above or go to Sister Stories and visit her Memorial page to make your donation.

Bequests & beneficiaries

Many friends of the sisters have chosen to make their final gift a lasting legacy in support of the monastery’s mission. These types of gifts are often generous but always bittersweet as the sisters are equally grateful and sad to have lost a dear friend.

Ways to give

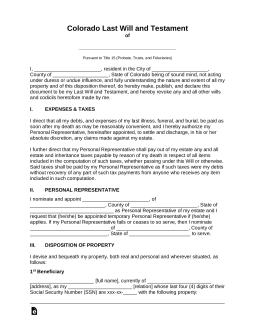

You may do this by making a bequest in your will with one or two simple sentences. Here is an example:

“I give to Benet Hill Monastery of Colorado Springs, Inc., a nonprofit corporation currently located at 3190 Benet Lane, Colorado Springs, CO 80921, ______________* [written specific dollar amount or percentage of the estate] for its unrestricted use and purpose.”

Yes, and many friends are choosing these alternatives. You could name Benet Hill Monastery as a beneficiary of a retirement account, life insurance policy, or many other asset accounts.

That’s completely understandable! Bequests and named beneficiaries are almost always changeable (or revocable). However, please be sure to consult your legal advisor to be certain.

Vehicle donations

Your used car, truck, or SUV might be old news to you, but it could be just the ticket to ride for the sisters! Our fleet manager may be needing to replace a vehicle that is becoming too expensive to maintain or to find a truck that our facility staff may use. Please give us a call!